Construction starts will rise 6% in 2022, which is above levels for peak year 2019, according to a new forecast by Dodge Construction Network.

That’s a drop in growth from this year, which Dodge predicts will be at 12%. But it still edges higher overall, to $946 billion, from this year’s predicted total starts of $863 billion.

Dodge Chief Economist Richard Branch cautioned that the main driver of the increase has been residential construction, and when taking those numbers out, construction starts would rise by only 4% and drop below 2019 figures.

“There is a long road back here to full recovery for the construction space,” Branch said.

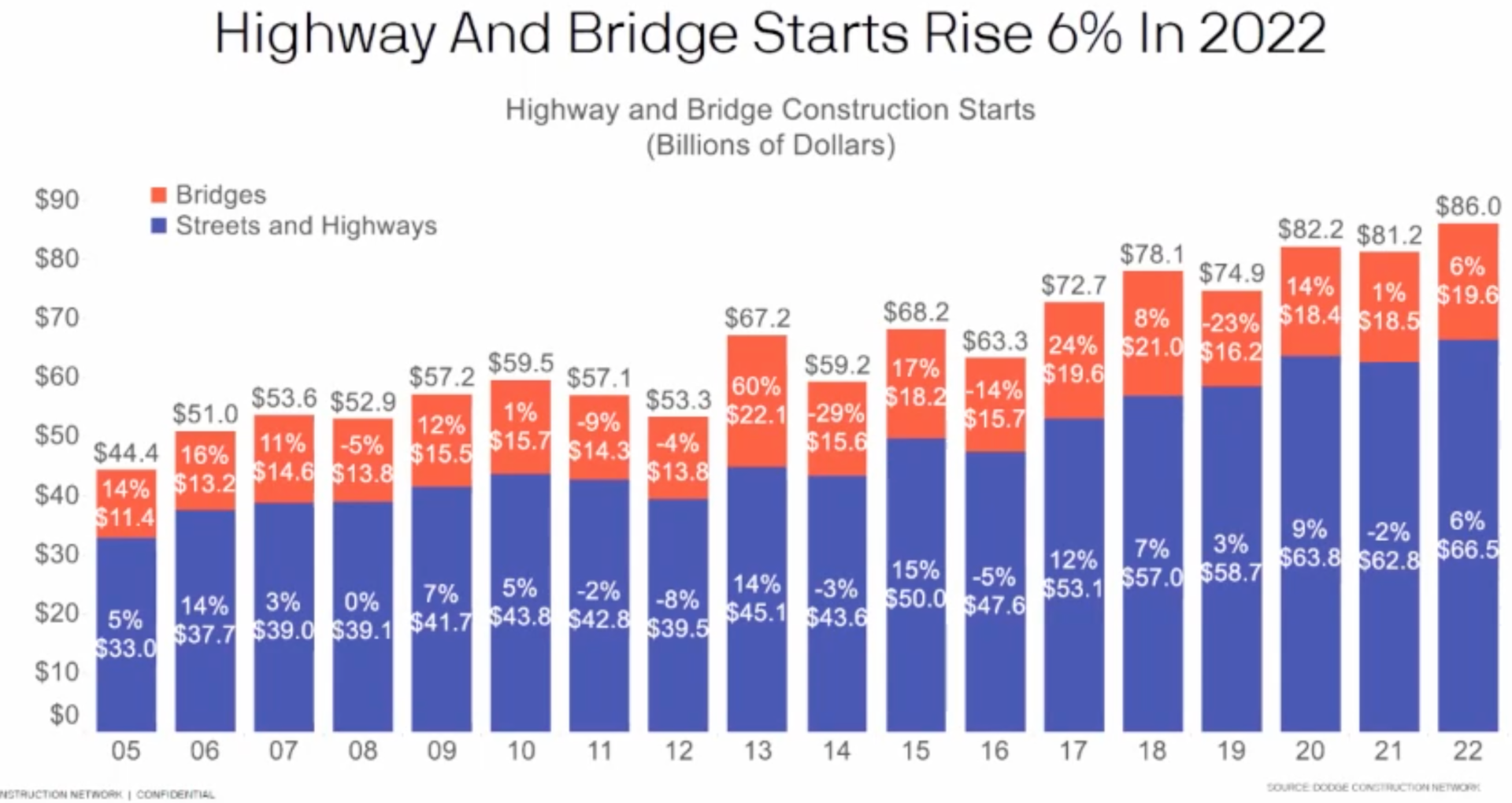

Branch noted, too, that the forecast factors in Congress preventing a government shutdown before a December 3 deadline, as well as raising the debt ceiling, and passing the $1.2 trillion infrastructure bill.

“But assuming that all comes to pass, we’re looking at a fairly modest to moderate pace of growth in construction starts in 2022,” he said.

He pointed to Dodge’s Momentum Index, which has risen throughout 2021 and is now at a 13-year high. The index measures nonresidential construction projects in planning. He also noted that the count of general building projects in bidding is ahead of where the industry was at the beginning of 2020 and is a little behind 2019. Some of those projects are under construction, with the rest starting in the final quarter of this year or early next year.

The Dodge Momentum Index reaches a 13-year high in 2021.Dodge Construction Network

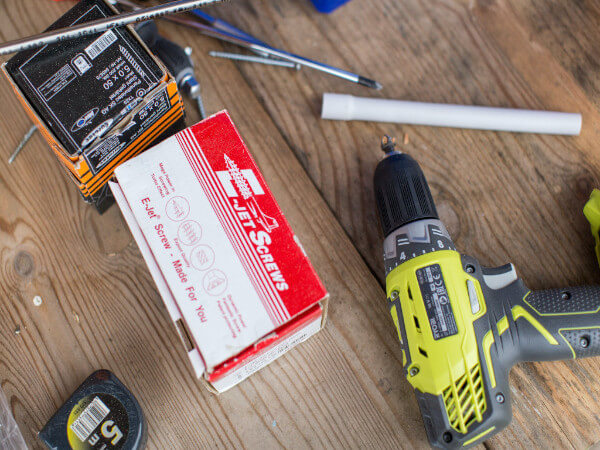

Material prices and shortages

Aside from Congress, the construction industry faces rising material prices and supply shortages that could dampen starts in 2022, Branch said.

Branch noted that material price increases are starting to erode, but they’re still 30% up over last year. He expects increases to continue until mid-2022, begin to pull back in the second half of the year, and remain high throughout 2022.

This chart shows the rapid increase in inflation of construction material prices versus overall consumer prices.Dodge Construction NetworkMaterial delivery delays are affecting 60% of small construction businesses. “And that is causing production delays, causing shipping delays and continuing to ripple through the lifecycle of a project,” he says. “So even as those prices cool in 2022, this web is very tangled, and these issues will continue to exert downward pressure on construction starts as we move into 2022.”

This also translates into construction projects taking longer to get started and completed.

“When we look at projects in our pre-planning stages, they are currently taking about nine months longer to break ground than they were prior to February 2020,” he says.

Another challenge is the labor shortage, but he notes that is not a new or temporary problem for construction. There are 350,000 construction jobs open. That compares to 400,000 openings in 2019.

“I think it’s very clear as we put all this together, that if not for the challenges and for the shortages and prices that we’re currently facing, that construction activity would be much stronger than it currently is,” he said.

Sectors looking up…and those not so much

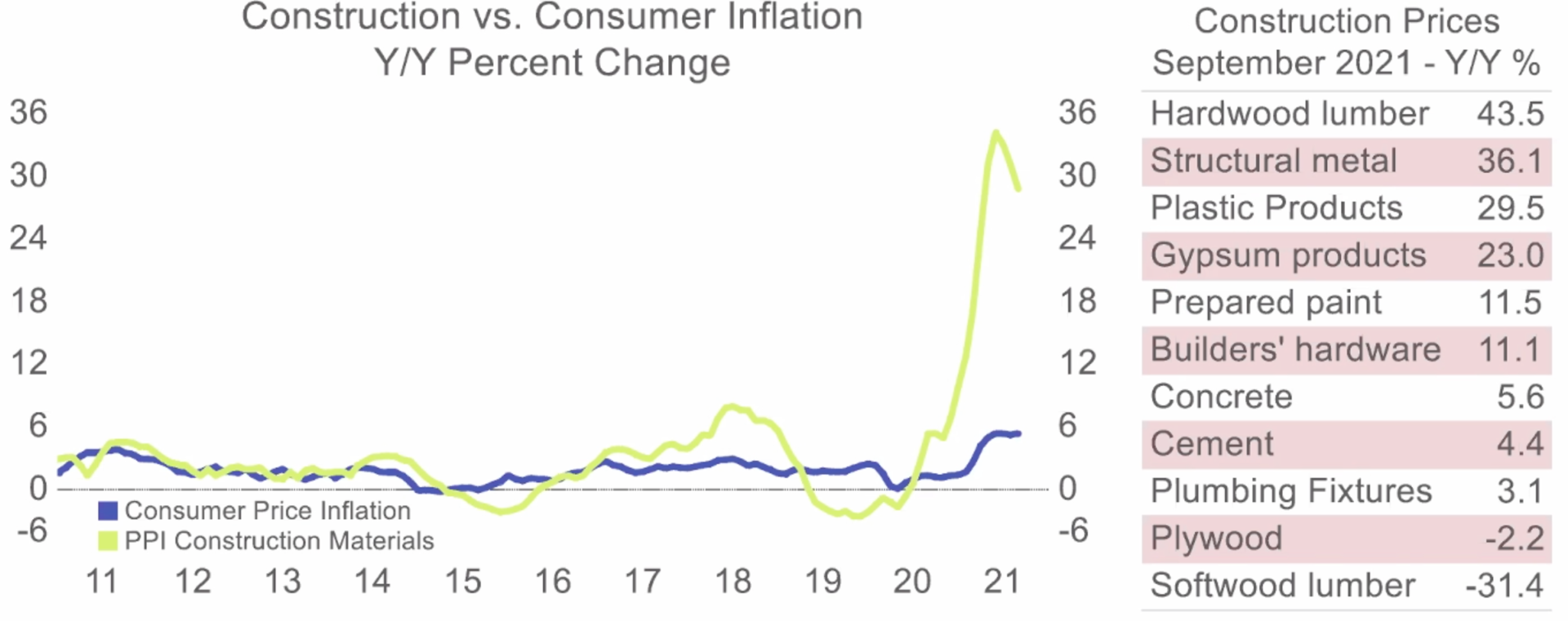

Branch sees a continued increase in single-family home construction in 2022 but not at the rapid pace of 2021, which is expected to post a 14% increase in total dollar amount.

He’s seen a drop in home construction in the second half of the year after an exceptionally strong late 2020 and early 2021.

Still, 2021 is a banner year for single-family home construction and on track to top 1 million units built for the first time since 2006. But the sector is also more vulnerable to high material, labor and land prices, and supply shortages, he says.

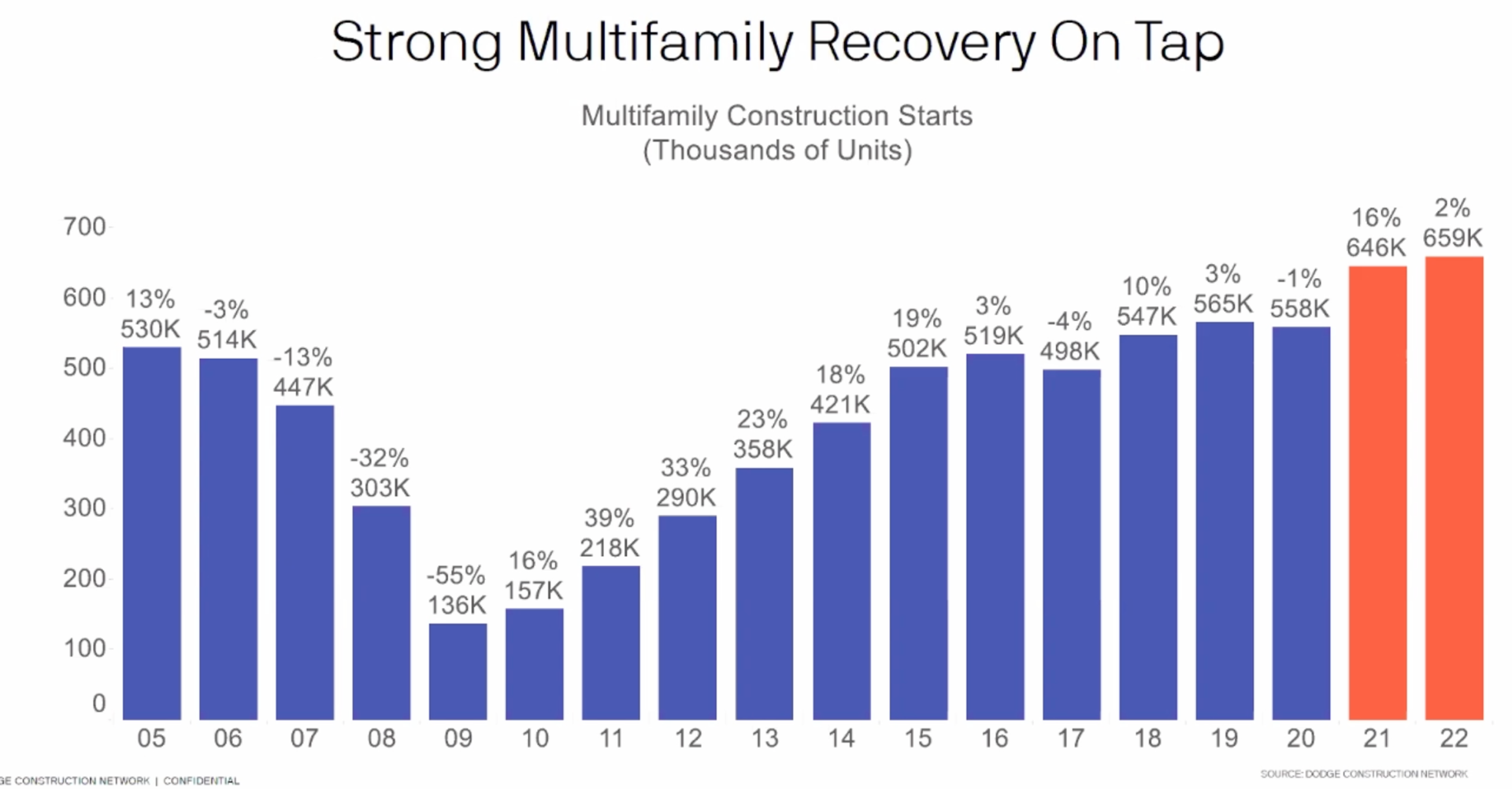

As the single-family market cools down some, the multifamily sector has taken off as the supply of affordable housing has shrunk dramatically. “We haven’t seen this kind of strength since the mid-80s,” Branch said.

The multifamily trend has also shifted from urban high rises to smaller suburban projects in the $25 million to $50 million range. The national vacancy rate has dropped to 2.9%, the lowest level since 1994. But he also expects the sector to hit a more normal rate of growth in 2022 as many projects were hastened in 2021 out of a fear of rising material prices.

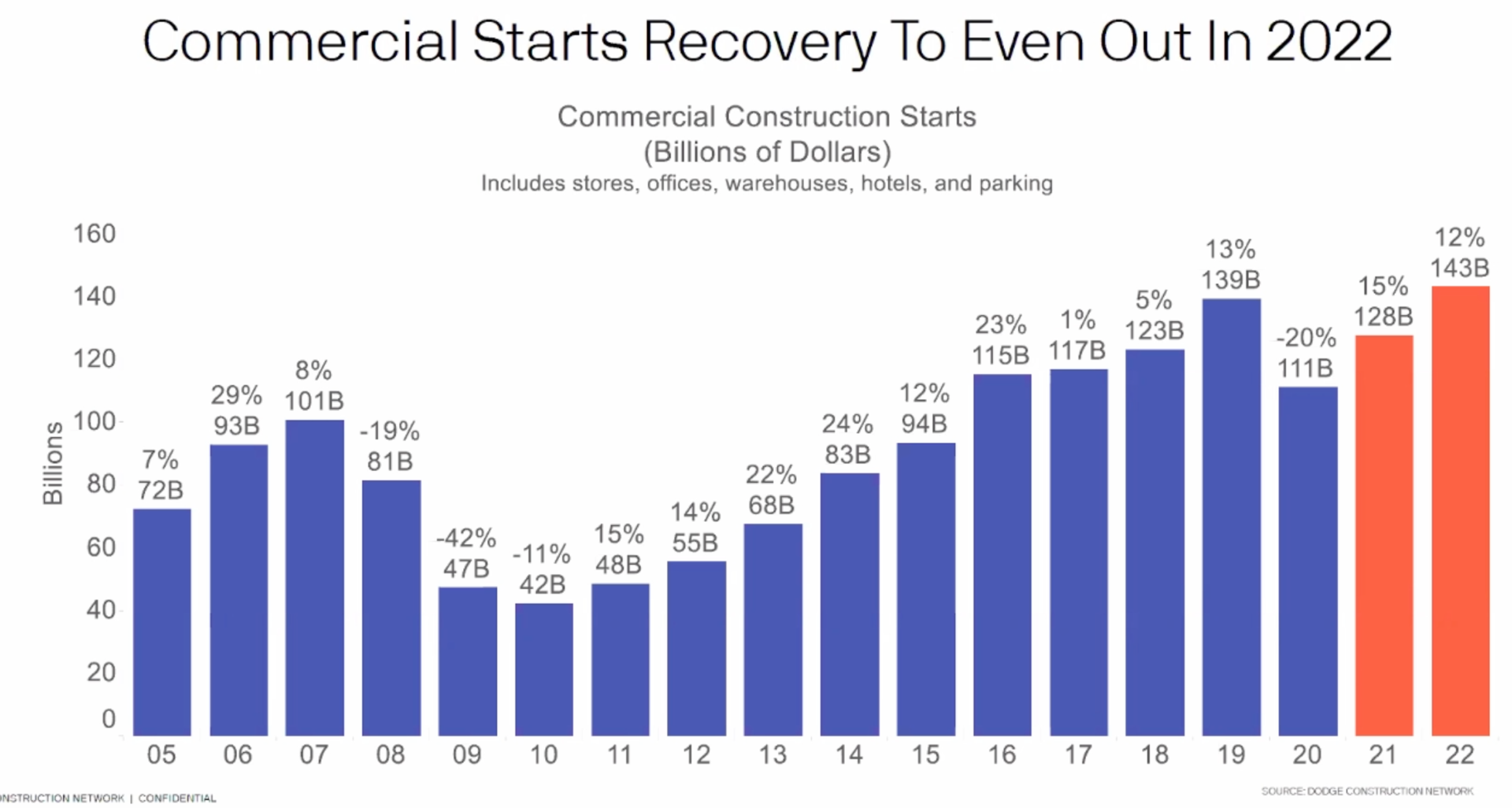

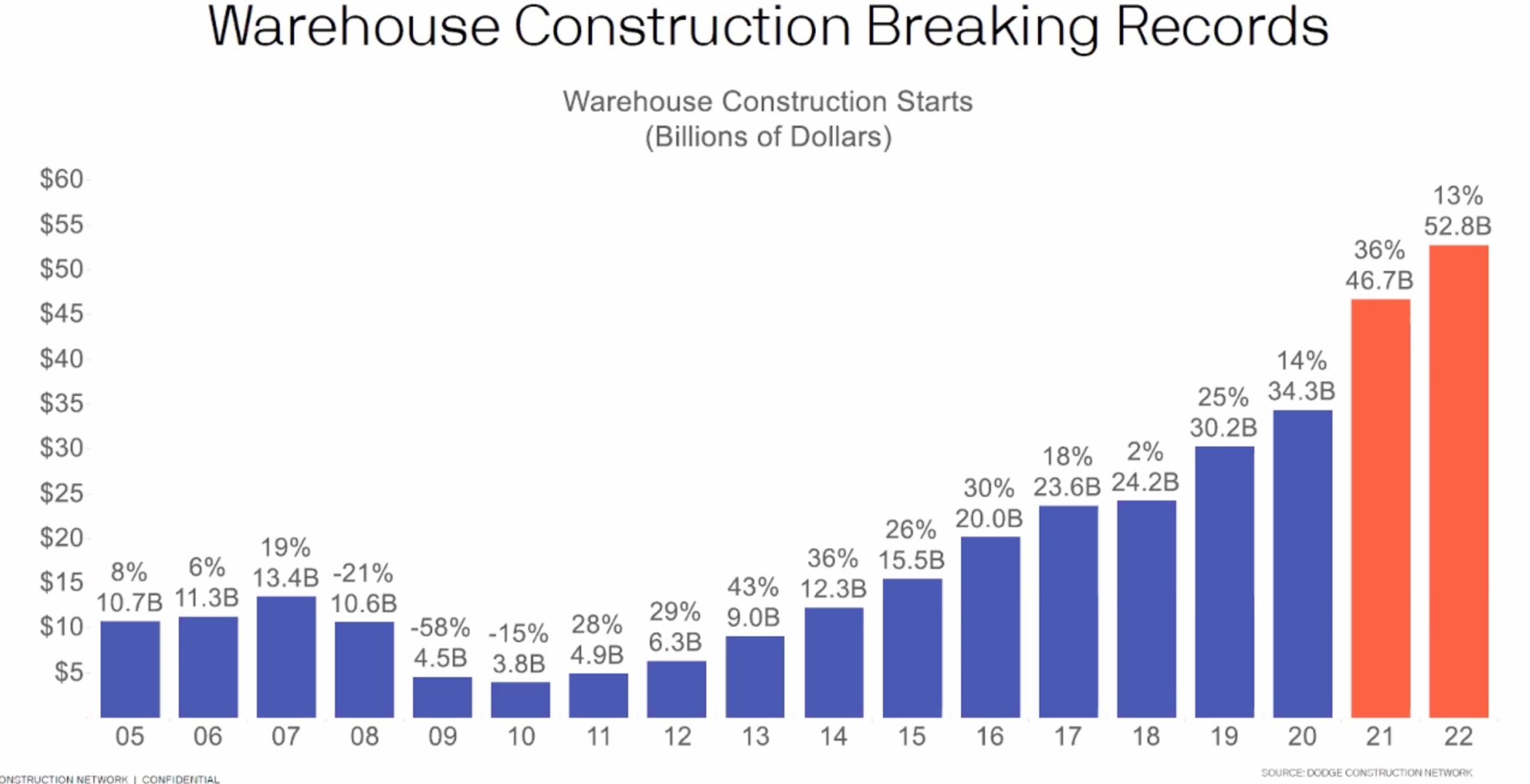

The warehouse sector also continues its tear, with Amazon leading the way building massive distribution centers. Warehouse construction has been the main driver of the commercial building sector and that will continue.

But Branch also believes commercial growth will become more broadbased in 2022, with a greater focus on office additions and renovations. Data centers are another big area of growth for the sector.

The manufacturing sector has also shown surprising growth, particularly in the petro-chemical industry.

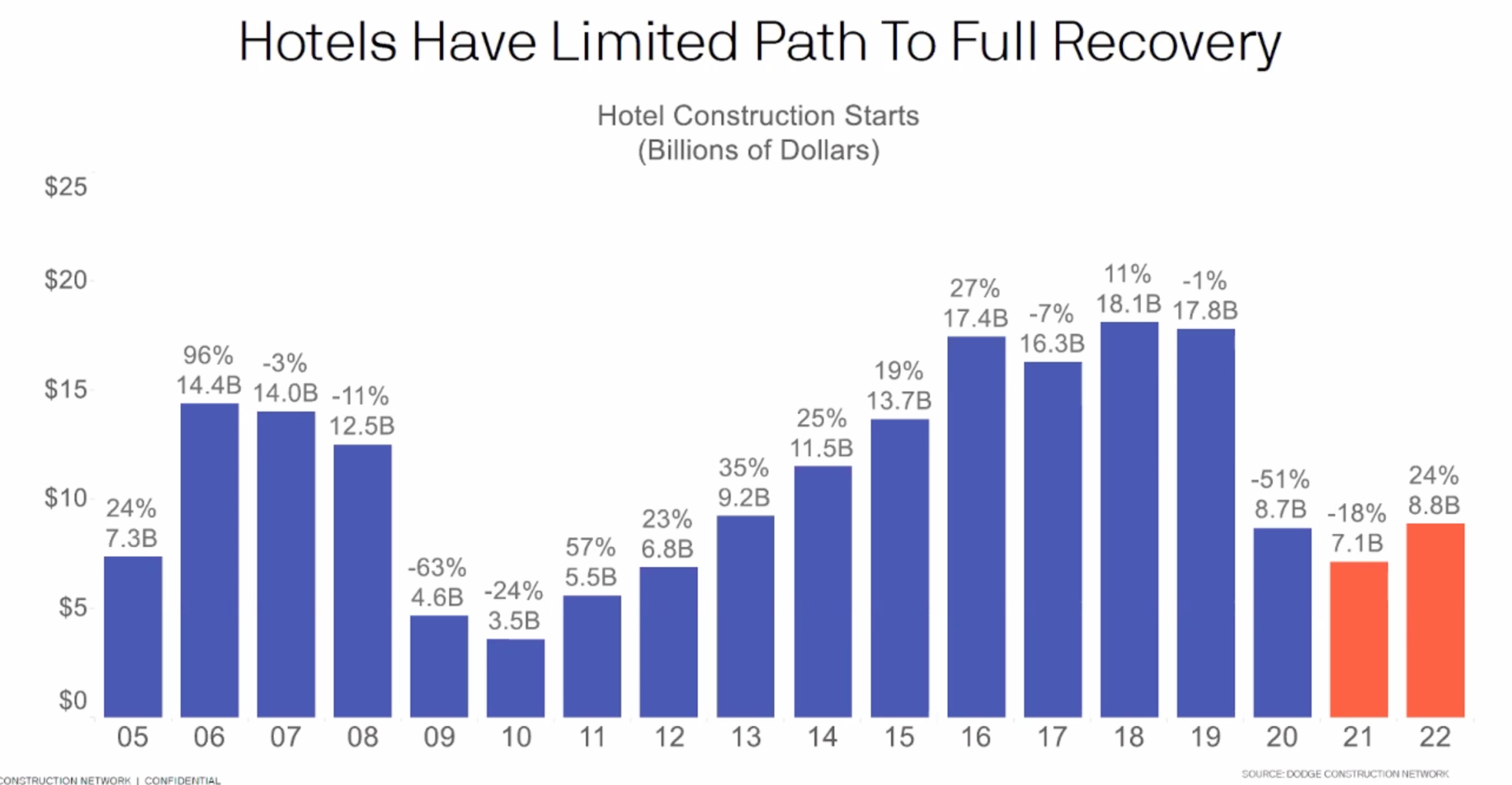

Branch saw a turning point in the third quarter for hotel starts, but the beleagured sector is still way behind its pre-pandemic levels and will continue in that position for the next five years.

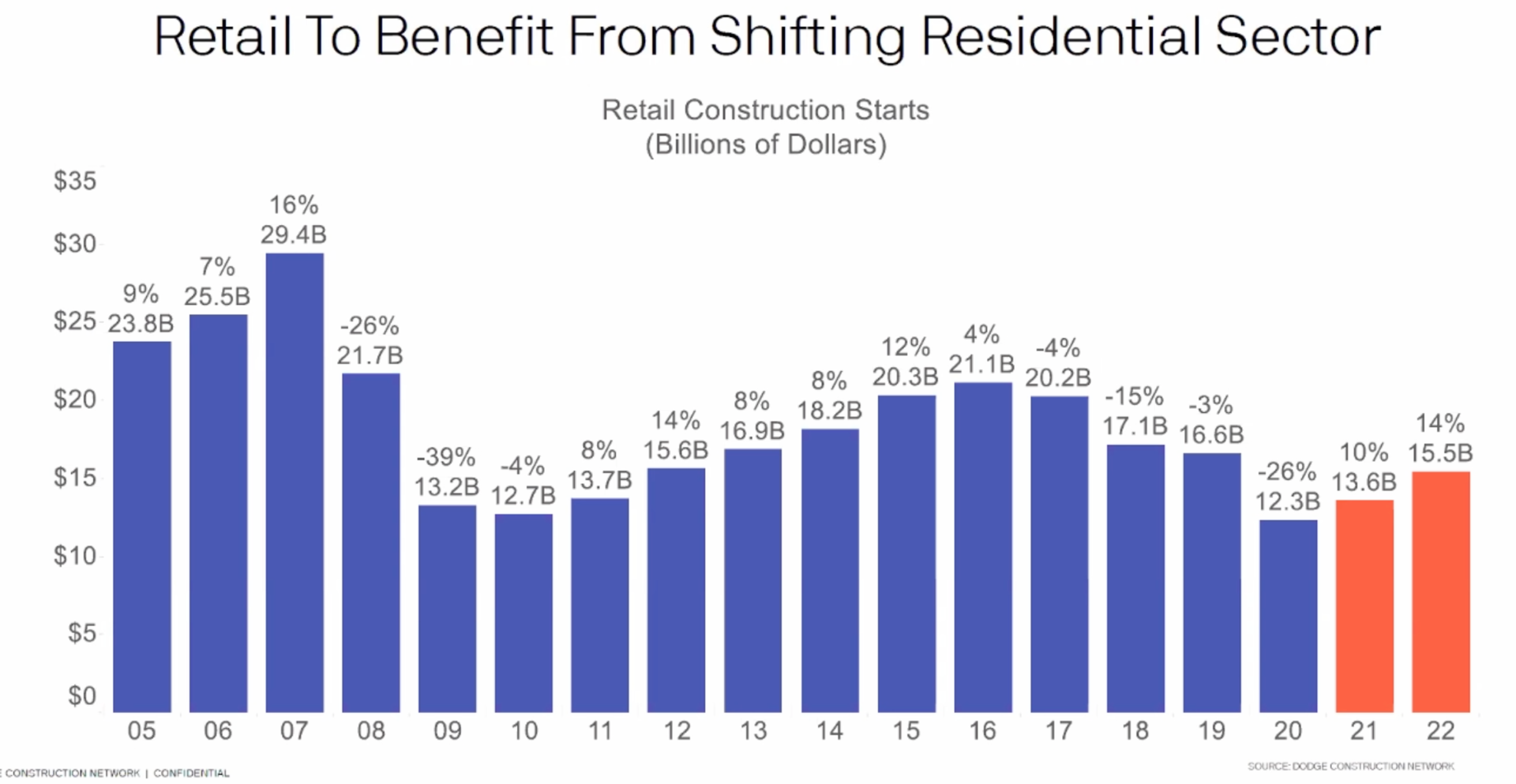

Retail also continues to lag, but he notes that as more people migrate from urban areas to the suburbs, retail projects will follow.

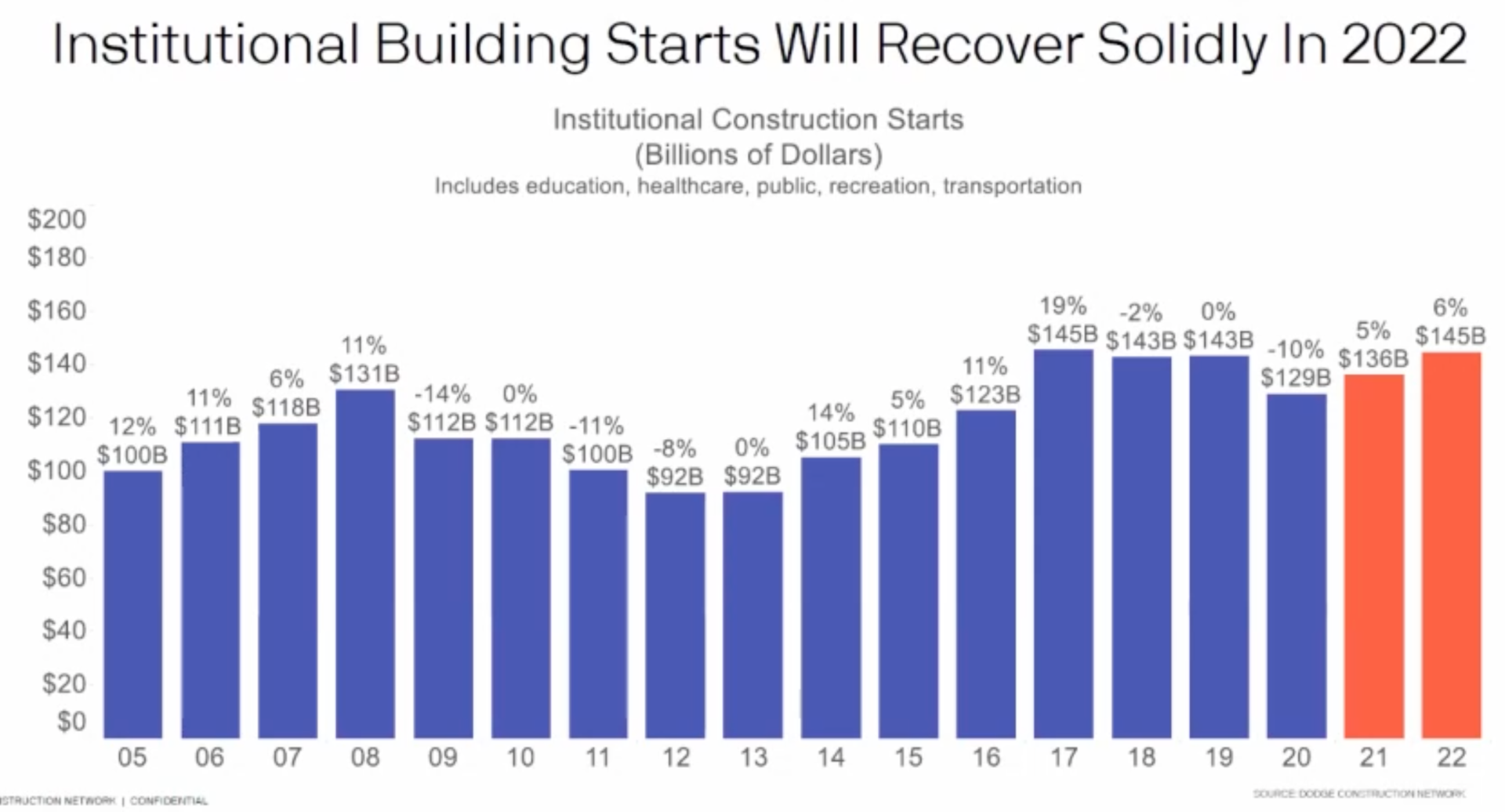

Charts tell the story

These charts released by Dodge Construction Network show how various sectors of the construction industry are forecast to perform:

Dodge Construction Network

Dodge Construction Network

Did you miss our previous article…

https://www.3555pacific.com/?p=401